#61: The Case Against Instant Checkout

Bearish on OpenAI’s Commerce Dreams

Two weeks ago, OpenAI and Shopify finally confirmed the rumors that they’ve been working on bringing shopping to ChatGPT. This new functionality called Instant Checkout allows users to purchase products directly within the ChatGPT interface. Currently being tested with select Etsy sellers, the commerce feature will be extended to Shopify-based brands soon.

It’s worth noting that OpenAI plans to take a “small” fee for facilitating the purchase, yet hasn’t confirmed what the specifics behind the fee will be.

The internet is changing. For the past ten years, consumers have become quite comfortable typing a few words into a little white box and sifting through a sea of options on a search results page. The advent of consumer-facing AI applications has not only eliminated the need to sift through search results pages, but OpenAI’s recent update has also removed the need to visit a website altogether. If you thought Amazon was a one-stop shop (pun intended), you can have ChatGPT edit your research paper and buy that dress you need for your friend’s wedding. It’s the one-stop-everything platform.

For the subscribers that have been here for a while, you know that I’m quite bullish about technology, particularly about the positive impact AI can have on our personal and professional lives. Still, utility doesn’t always equal impact. When I read the OpenAI x Shopify partnership announcement, I couldn’t help but ask myself, “so what?”

Now, I don’t want to undermine the seismic shift that AI is beginning to have on how people search and discover information, particularly in the commerce industry. But I can’t help but think that even if the purchase experience should in theory be more efficient, it’s not like people are going to now spend a ton more money because… AI.

Recent Federal Reserve data suggests that the top 10% income bracket makes up nearly half of consumer spending in the US. That means high-earners are doing the lion’s share of heavy lifting when it comes to consumer spending growth (PCE Index: 0.6% YoY in August’25). Top earners are spending more because their investment holdings continue to increase in value. However, if the AI bubble pops, it’ll have a dramatic effect on the broader stock market. Thus, it’s very likely that the top 10% earners will slow down on their spending. When that happens, consumer spending overall will take a dip and OpenAI will be dealing with a situation where their market share will need to be taken from others, not riding on the coattails of new demand. As I said earlier, people don’t necessarily get wealthier just because the UX built by a private company is better.

OpenAI reports that ChatGPT has 700M weekly active users, but how many of those 700M fall into the “big spenders” category that is the top 10% income bracket in the US. Technologically, Instant Checkout is fascinating. But economically, I’m skeptical of whether commerce is that big of an opportunity for OpenAI.

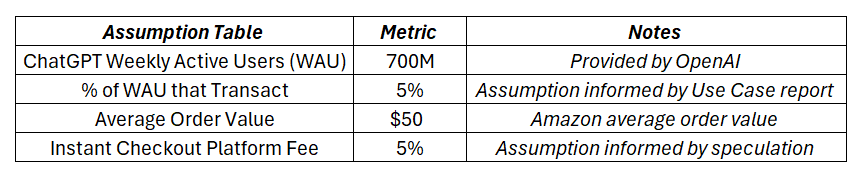

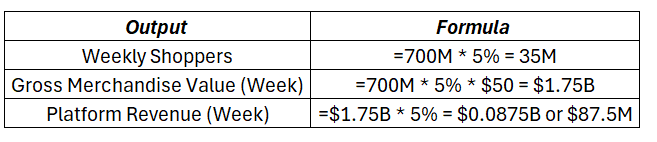

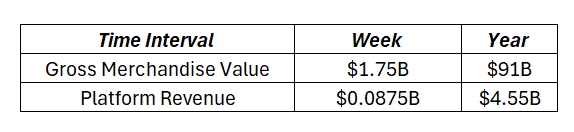

Here’s some rough math to estimate how much OpenAI can make off Instant Checkout per year.

Average Order Value. Let’s use Amazon’s Average Order Value (AOV) as a proxy for Instant Checkout customer’s order behavior, which is ~$50 according to third-party analytics estimates.

Weekly Shoppers. Generously speaking, if OpenAI can convert 5% of their user base into shoppers, that leaves them with 35M weekly buyers. Side note: this 5% assumption isn’t too ambitious given OpenAI’s Use Case report showing that 70% of consumers use ChatGPT for non-work tasks like decision support (of which shopping advice would fall under this umbrella).

Platform Fee. Let’s assume that Instant Checkout charges a 5% fee to the merchant per transaction. It may be less, like closer to 2% or 3% as per online chatter. But let’s go with 5% as a lower-range assumption, when compared to other online marketplaces.

Can OpenAI get 35M people per week to spend $50 and how long will it take them to get there? But most importantly, where is this sales volume (gross merchandise value, GMV) going to come from?

OpenAI currently has an Etsy integration in place and Shopify is soon on the way. Etsy as a marketplace puts up ~$12B in GMV per year, and Shopify reports ~$300B in annual GMV. By my estimates (which could be wildly optimistic, please comment below what you think), Instant Checkout will receive about one third of these massive platforms volume. Will there be a pure share shift of demand from shopping on brand websites to shopping in a prompt format? Or will new demand be created?

In terms of demand generation, I’m dubious as it’s not like people just suddenly have more disposable income because the user experience is cleaner. Remember, 10% of US consumers make up 50% of overall spending. I don’t know how much more we can squeeze out of the top 10%.

A few more comments.

If you believe that Instant Checkout has a tremendous growth story ahead of it, you are likely to believe that people will visit brand websites significantly less often. This has drastic implications on how brands prioritize their resources and acquire/retain customers. It’ll increase the importance of winning in AI search and shift brand resource budgets to Generative Engine Optimization (GEO).

Next, OpenAI will need to steal share from the incumbents, Amazon and Walmart. See, Amazon nets nearly $700B in GMV per year, while Walmart boasts $100B in e-commerce GMV. Maybe these two goliaths will sit tight, while OpenAI steamrolls into their turf.

Kidding, that’s not going to happen. There’s too much at stake. But there’s also the need to retrain purchase behaviors and habits. Think about all the people who rely on Amazon Prime.

Amazon has nearly 230M Prime subscribers, which means that roughly every other person in the US has a Prime subscription. Walmart isn’t too shabby either, boasting 27M subscribers for its Walmart Plus program.

Finally, people like shopping on these websites. And consumer behavior is sticky. OpenAI is going to have to roll out much more in the way of benefits to shoppers to steal share from either Amazon or Walmart. Which makes me think their real sales opportunity lies with Etsy and Shopify, a much smaller pool.

But this all could be a distraction or a first move from OpenAI. It’s clear they are looking to turn up the dial on their monetization efforts and commerce is a natural first step. I wouldn’t be surprised if Instant Checkout is a data play to learn more about a person’s shopping behavior. That data could ultimately fuel a new ad business. And maybe it’ll help inform OpenAI’s hardware ambitions. The data they can capture from transactions will be vast and will kickstart the flywheel at what some consider the most ambitious company in history.