#17: How Tariffs Will Gut Consumer Brands

Policy changes and how your favorite brand is likely to react

It’s been an eventful fortnight following Liberation Day. Market gyrations and flip-flopping international policy have dominated the headlines on all major forms of media.

All sorts of companies are scrambling to figure out how tariffs impact them both directly and indirectly. But you know which sector is thrilled with all of the tariff chaos? The media business. So much available fodder for them to spin up sensationalized stories on repeat. Next time you’re scrolling your feed or surfing the web, be self-aware of when you only skim headlines and subsequently feel angst, instead of reading the full article to understand the full scoop. Media is predicated on monetizing your attention through advertisements and subscriptions, so please be mindful next time you feel an emotional reaction from an overly cynical headline.

“It’s never as good as it looks, and it’s never as bad as it seems.” – Scott Galloway

Well, unless you’re an operator in the CPG space. Then it’s as bad as it seems. Let’s walk through some math on how tariffs impact the cost of goods sold (COGS), and ultimately what this means for brands and their customers. Given they are the focal point of the trade war, we’ll focus on China and specifically the US’s new import policy towards Chinese-manufactured goods.

But first, what is a tariff?

According to Oxford’s finest dictionary, a tariff is “a tax or duty to be paid on a particular class of imports or exports.” Tariffs can vary based on the product type being imported and are certainly a trickier topic than the blanket rates that are being reported in the news.

Prior to the tariff escalation, the US charged a 20% tariff on the dollar value of Chinese imports (exception: de minimis law, which we discussed at length in I Bought Electrolytes from Quince). Nowadays, a 20% tariff seems innocuous, doesn’t it?

Let’s say you sell a widget for $50.

If your COGS were $10, your tariff charge was $2 ($10 * 20%).

Total Cost: $12

Enter the 145% tariff (as per April 9th), an increase of 125% vs. the original tariff.

Your COGS value stayed the same, but your overall cost sure didn’t. It spiked big time.

Total Cost: $10 + ($10 * 125%) = $24.50

You are paying more in tariffs than you are for the physical product. Ouch.

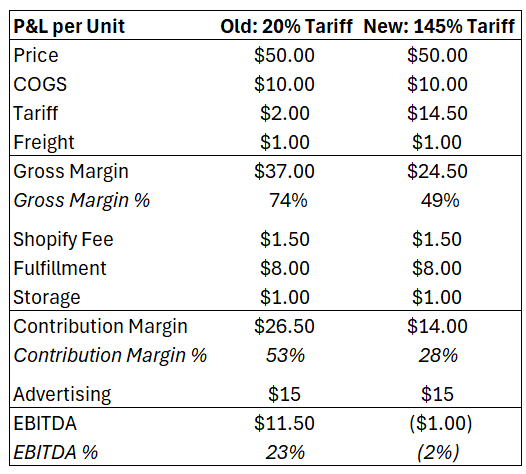

Check out a simplified P&L per unit for a DTC brand (sales channel: Shopify).

The math is broken. Busted. The drop in gross margin and contribution margin tells it all.

What does this all mean? In the 145% tariff example, the brand is losing money on the $50 product. Losing money on a per unit basis is not going to cover company salaries, let alone office space and other overhead. Additionally, onshoring manufacturer relationships or receiving concessions from your existing factory in China doesn’t happen overnight. It takes months, if not years, to pull off at scale. And here’s the thing – even if your full supply chain lives in the US, it’s likely that an input of your product comes from China, of which will be subject to the tariff hike. Your overall COGS won’t be subject to the 145% tariff, but if an input that makes up 50% of your COGS value is, you’ll have to reevaluate your profitability equation.

The obvious response to the tariff battle (who knows how long it will last, perhaps this article will soon be obsolete) is that brands will increase their prices. Which I’m sure brands will do so. However, it’s a more nuanced conversation. Check out five ways brands can manage their P&L to help offset the tariff impact without having to raise the per unit price. Furthermore, it’s important to be aware of these actions as you may be spending more on your next online purchase and not realize that you fell into the trap.

No More Free Shipping

Free shipping has become the baseline expectation of consumers thanks to Amazon. Not only is it commonplace not to pay for shipping, but it’s also a give-in that your order will arrive in two days.

For everyone who is not named Amazon or Walmart, shipping is very expensive (frankly, it’s still expensive for Amazon but Amazon mostly passes that cost on to the brand). I expect brands to either charge a flat rate for shipping on all orders or perhaps increase their free shipping order value substantially.

Minimum Order Quantities

You normally buy one fancy shampoo bottle at a time from your favorite cosmetic brand? Well now, you may be required to buy in bulk. There tends to be economies of scale on shipping costs when you can pack multiple items into one box. In the shampoo example, it’s likely you’ll need to buy three bottles at once, instead of being able to select one bottle at the checkout.

Removal of Lowest Price Option

A common pricing strategy in CPG is to offer three products and ascending price points and quality, respectively. It’s called, “Good, Better, Best”. Brands tend to take a lower margin for the “Good” with the hypothesis that consumers will trade up to a higher margin product when they land on the product page. Now, the low margin “Good” option may be unprofitable, thus you may see this option discontinued over the next few months.

No More Free Products

“Spend $150 and get a free hat”. Yeah, that’s likely going away. I’ve seen that offer come through from brands like Vuori and Ten Thousand, but don’t expect to see it again any time soon. Brands need to monetize every part of their business and can’t afford to give the product away anymore.

More Bundle Offerings

Akin to the minimum order quantity point, brands need you to spend more. And what’s a way to get someone to spend more and offer additional perceived value? Provide a curated collection of products that work complementary to each other. Expect more advertisements around “kits” or “bundles” or “starter packs”. There’s certainly a merchandising risk here, as not all items included in a bundle may be relevant to the customer.

There you have it, folks. Consumer brands are about to be hit hard, and they are going to need to react deliberately and surgically to not temper customer demand. They’ll quietly pass on the cost increases to consumers in subtle ways.