#47: Separating Signal from Noise in the AI World (Part II)

Debunking three popular AI narratives with data

Back for Part II. Today, we’ll be diving into the headlines that are all hype. I’ll be highlighting statements that sound smart but aren’t backed by the data. We’ll be leveraging SimilarWeb’s AI Global report to disprove these “hype takes”.

Curious about which trends are legit? Check out Part I here.

Here we go.

Note: all graphs are screenshots from SimilarWeb’s AI Global Report.

Hype Take #1: AI is drastically disrupting the Consumer EdTech sector, and the incumbents are adapting quickly to the times.

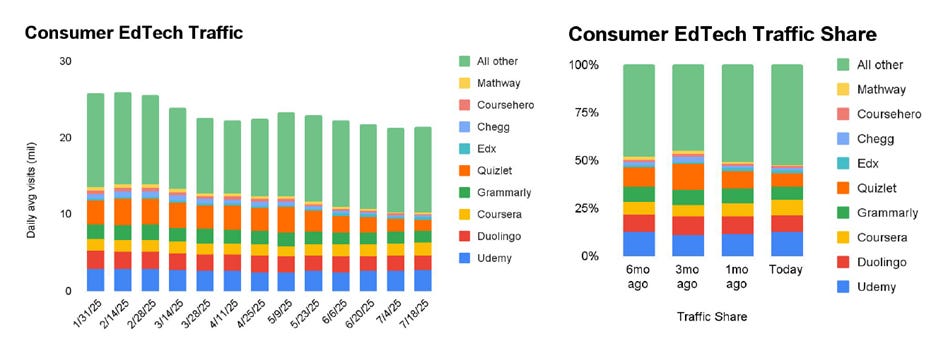

EdTech traffic is trending down, and the market is becoming increasingly fragmented. Major players are losing ground, creating a path for the challenger brands to steal market share.

I’ve previously written about how outdated the educational system is in AI + School, and how AI advancements are the eureka moment that may finally cause a much-needed change in how students learn. But the Udemys and Courseras of the world are stuck in the mud. They aren’t adapting their offerings fast to compete with new AI-native players or chat interfaces like ChatGPT or Perplexity.

The most interesting data point here is regarding market fragmentation. Lately, the ‘All other’ category is the only one showing growth and makes up the largest share of traffic. This tells me that there’s ample opportunity for disruption. The AI story on EdTech hasn’t been written yet, so there’s a chance that the big players in five years may not have even been founded yet. EdTech might be a sector one of the LLM creators looks to own, as they are heavily influencing how people search and discover information more broadly. Or, a vertical player will be born, reinventing how we learn with an AI-native mindset.

However, I am surprised that Duolingo hasn’t run away with this market, as AI is critical to powering their voice recognition capabilities. Compared to former heavyweights who have turned into meme stocks (*cough* Chegg *cough*), Duolingo’s seemingly endless learning paths are some of the finest AI vertical applications I’ve seen (oddly enough, they received backlash for being public about how AI-centric they are). I would have guessed that creating a better product through AI would lead to larger market share, yet the data isn’t telling us that. Of course, language learning is only one sub-vertical in the broader EdTech market, which may help explain why its traffic share isn’t leading.

Hype Take #2: AI content generation start-ups have been growing at a blistering pace and there’s plenty opportunity for future growth.

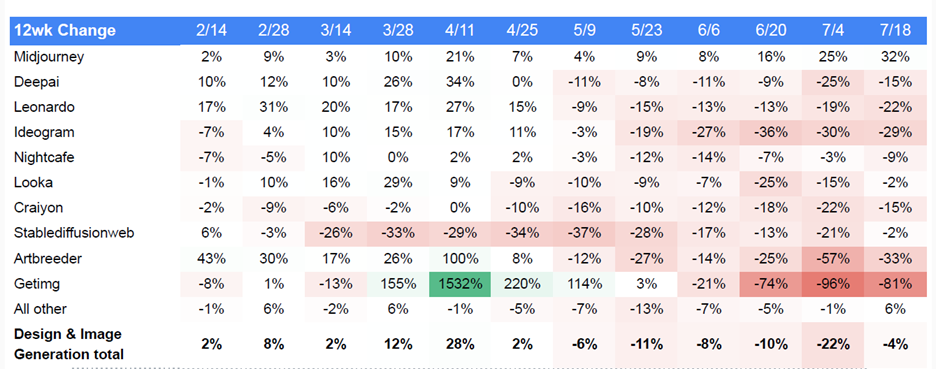

AI design and content generation start-ups are at an inflection point. Anecdotally, I hear more people relying on AI to generate pictures and videos as creative assets for their business. However, the data shows growth is slowing particularly for major players not named Midjourney. AI tools began to experience notable traffic declines by early May, with all of them declining around the same time.

Two big headwinds are looming in this space. Primarily, ChatGPT’s image generation likely isn’t helping these start-ups that don’t have a sticky client base yet. This feature came out towards the end of March, which I hypothesize coincides with the drop in traffic we see shortly after for most of the players in this market.

Another issue is the growing wave of copyright infringement lawsuits. Disney and Universal recently joined forces to sue Midjourney for copyright infringement, citing a Midjourney prompt can create a spitting image of their characters. Problem is, Midjourney reportedly lacks licenses to train on content from either firm. It’ll be fascinating to see how this legal battle plays out, as Disney and Universal plan to take Midjourney to court over the matter.

Midjourney has the strongest brand recognition in this category, which helps explain their steady growth. Unless you’re leading the category, you risk losing ground by an LLM’s product suite (i.e. ChatGPT). But who knows how long Midjourney will keep their momentum if this lawsuit alters their model training strategy.

Another wrinkle is that existing design software incumbents have integrated AI rather seamlessly into their current interfaces, home to many millions of monthly subscribers. I’m talking about Adobe, Canva, and Figma. I’ve played around with Canva’s tool impressed me for quick tasks like static ads. These all-in-one platforms that can effectively integrate an AI layer to their existing product suite should be safe. Even amid major product announcements from LLMs.

Hype Take #3: The digital freelancer market is in freefall, as AI agents have fully replaced the need to hire an external contractor.

Okay I admit: this trend is having some merit now. In the chart below, the digital freelancer market is contracting compared to last year. However, over the past two months, the downward acceleration has slowed.

I don’t expect AI agents to completely wipe out the digital freelancer market because that assumes widespread willingness to learn how to use AI agents. It also assumes that these marketplaces won’t add AI services for prospective clients. Still skeptical? Well, Upwork has an AI Services section front and center on its home page.

The mix shift on digital freelance marketplaces may change though. I see it likely moving away from design and creative jobs as there are plenty of self-serve AI tools that can get the job done. But to build an AI agent to do a specific task for your business? You’ll ask a freelancer to build that for you. New technology brings about a learning curve, and people will still pay to get over the hump.

In the long term, I expect the digital freelancer market to structurally decline as AI agents become more accessible and easier to program (or vibe code). Agentic browsers like Perplexity’s Comet will centralize agent creation. Customization will likely still require niche expertise. And you can find those skills on a freelance marketplace.

Which AI narratives do you think are legit, and which are overhyped? Let’s discuss in the comments.