#48: Your Product is Your Marketing

David Protein is selling boiled cod and it’s smarter than it sounds

America is obsessed with protein. From familiar non-meat sources like bars and powders to unexpected formats like coffee and candy, new protein products find their way onto the market constantly.

But if there’s one company that’s embodied America’s protein kick more than anyone else, it’s David.

David Protein brands themselves as a “platform that designs tools to increase muscle and decrease fat”, which sounds like a reach as their main product is a protein bar. However, this grandiose statement ties well with their long ingredient list, as reading it feels like a science experiment is taking place in their bars. Yet, from the name to the mission statement, every word feels engineered. David is playing chess, while the rest of consumer brands are playing checkers.

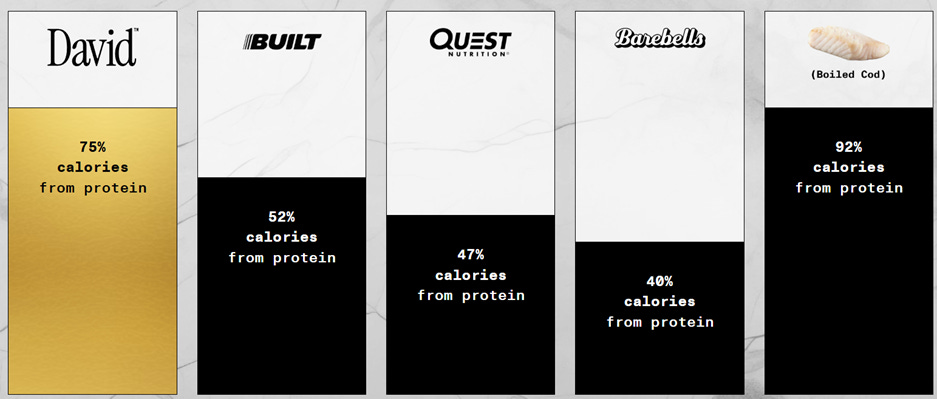

David knows they operate in a saturated market (protein bars), so they introduced the highest protein and lowest calorie bar combination on the market. It’s so efficient in calories-per-gram-of-protein that they regularly compare their bars to fish, specifically cod.

I’ve been eating David bars since late 2024 and I’ve always found this picture comparison quite odd. David bars are man-made, and they are being compared to a natural fish.

But then David started selling boiled cod last month.

The launch attracted a lot of buzz and mixed reviews on taste. However, David is selling boiled cod, which has the taste profile of a carpet so there’s a low ceiling on how good their product can realistically taste.

If it ships fine and tastes like cod, complaints aren’t a problem. Because it’s a marketing stunt.

Since the protein-to-calorie ratio of boiled cod isn’t much higher than David protein bars (92% vs. 75%), it further highlights just how efficient David protein bars are. They aren’t looking to compare themselves to other bars in the market, they truly are in a league of their own. And in a protein maximalist culture that is America, David is appealing to the current climate. They are leaning into the protein obsession so much, basically saying that eating one of their bars is nearly as protein-maxing as a natural source, fish. So why go through the hassle of buying and cooking fish, when you can pick up one of their bars that doesn’t require prep time. If you’re protein maximizing, do you really care about the source?

The cod launch serves as marketing for David’s full assortment of bars. Flashy consumer brands don’t sell boiled cod, so the surprise helped David garner millions of branded impressions across social media. Funny enough, cod is the only product not sold out on their site (as of August 4th). David is well on its way to being David Cod.

Cod is a bland food, which is exactly why it works. Placed next to a sleek, aspirational brand like David, the contrast is the point. And in this very ideal scenario for David, boiled cod is the marketing. It represents everything David is not (basic, whole food), which is why it went viral. People are drawn to the shock factor.

Launching new products is critical for brand survival as without innovation, a brand’s offerings get stale. Even Nike has released so many variations of their iconic Air Force 1 shoe. If you’re a consumer brand operator and you’re hesitating on launching new products, you should realize you’re not better than Nike and get to work on launching more products.

David gets it. Not only have they released eight flavors of their bars, but they also introduced an entirely new product in the way of cod. But I doubt their boiled cod will be around in a year. It’s a splashy marketing tactic that highlights their protein-efficient bar and diverts attention away from another matter.

The lawsuit.

A few months ago, David bought the factory that produces EPG for its protein bars. EPG is a type of fat that has 92% fewer calories than traditional fat, without compromising a product’s taste or texture. This ingredient allows David bars to be low in both fat and calories, but high in protein.

It’s a savvy move by David. They raised a round of fresh funding ($75M to be exact) and used part of the paycheck to buy a key factory in their supply chain. The problem is David owns the factory, as well as the patent to create EPG, and has decided to cancel all existing manufacturing agreements with other brands.

Companies like Nick’s Ice Cream that use EPG in their products are in tough shape since this scarce ingredient is critical to their macro-efficient products. Naturally, consumer brands that rely on EPG are suing David because David no longer allows their ingredient to be produced for others at the factory.

Remember, David is calling themselves a “platform” now and will likely begin branching into other food categories besides protein bars. Any product that leverages EPG presents a clear opportunity to enter an already validated market. David probably has a list of future products, but the easiest wins are the ones already using EPG.

It sounds anti-competitive. That’s because it is, which is another reason why David could benefit from a funky distraction.

The factory and patent purchase for EPG further drives home my point that the boiled cod launch is a savvy consumer brand marketing tactic. It’s not core to David’s ethos as a platform, which will likely center around launching products that contain EPG.

If you were hoping David bets the house on becoming a direct-to-consumer seafood brand, I’m afraid you’re mistaken. The David Protein team are world-class operators and have created a textbook example of how your product can be your marketing strategy.